|

Those who want top-down control of the world would encourage us to be either isolated or in conflict with each other. But on this cold, frigid Christmas Eve, those of us willing to be together have each other to keep ourselves warm and hopeful.

|

This is Noticing New York's annual seasonal reflection.

On this Christmas Eve the wandering polar vortex has brought us frigid temperatures here in New York City. It was ten degrees this morning when I first woke up and checked the temperature. We attribute these frequent extreme weather events, both extremely icy frigidity and, alternately, sometimes unseasonably balmy warm winter days, to the slowing of the jet stream (caused by climate warming) that corrals the polar vortexes; no longer effectively corralled by less swift winds, the vortexes lose their shape, becoming octopussy and wander out of place.

But in this cold we have each other to keep us warm. . . that is, if we haven't been driven apart or into conflict or driven just to hole up in self-imposed solitary confinement out of Covidian fear. It's almost 2023 when we will be entering year four of whatever Covid craziness we chose to continue. And there are those for whom it seems it will never be over, who have gone from not wearing masks (placing some kind of hope in them- just what who knows) back to wearing masks again. Mayor Adams' city administration recently told people that that's something they should do.

But for those of us who are together, who have not been driven apart, or, as I said, into conflict with each other, we have each other to keep ourselves warm and joyful.

We all now live in a world where people who are seeking to make things increasing top-down controlled try to isolate us. They generate conflict among us and seek to make us suspicious of each other and generally fearful. Conflict is generated, not only here, but also around the world. America is a perpetually warring nation. At the bidding of the powerful we have a thousand military bases around the world. We don't do anything about it.

In 2019 as Christmas approached, the season where we purport to venerate peace, I wrote an open letter to the minister of our Unitarian Congregation, the First Unitarian Universalist Congregation of Brooklyn, requesting a sermon about peace. I pointed out that for as long as we had been attending, since the mid-90s, we'd never had one. It's now the end of 2022, and despite that request we still have never had one.

My letter request, still relevant, is reprinted again further on in this post.

That was 2019. In the Covid lockdown craziness era the Unitarian congregation has gone on to exclude from its premises of `welcoming' worship anyone who has not had the Covid spike manufacturing injections and anyone who does not wear a mask. The church is using its influence demanding these things of the congregation's children as well. . . . I wonder about the lost art of whistling. You can't whistle "Jingle Bells" of "Dreidel, Dreidel, Dreidel" with a mask on. I wonder if people will remember how to whistle when they stop wearing masks? Have you noticed the how you've heard less whistling in the past three years?

. . . . Of course, you can't share your smiles either. All your facial expressions are covered up and hidden. No wonder we feel suspicious of each other and feel more alone and apart.

Did I say that those of us socializing and not driven apart have each other for warmth, including emotional warmth? Julian Assange is still being held incommunicado and being tortured in a high security British prison, Belmarsh, Britain's Guantanamo.

Last year's seasonal reflection we wrote about Julian's imprisonment on trumped up charges he hasn't been convicted of and should never even be rightfully tried for. Julian has never been mentioned during a Unitarian service of our congregation. It's Julian who has said, different times in slightly different ways: "If wars can be started by lies, then peace con be started by truth."

|

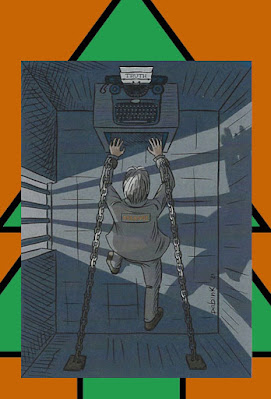

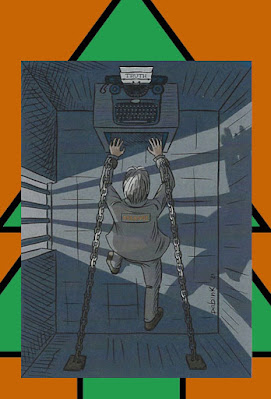

Julian Assange at Christmas- The center image from the WeeklyLeaks site and magazine- Julian, in his prison cell, chained cannot reach the keyboard to give us truth.

|

Let's stand together and share truth as we are warm and convivial together.

I still subscribe to the New York Times. I get it to know where the propaganda is headed. The Times is always in the lead. Once upon a time it was called the "good grey Times." That does not mean that it was accurate then as it cheered on various wars and conflicts such as what was called the "Vietnam War," extending into Laos and Cambodia with between 4 to 5 million Asian casualties. It only meant that it adopted a pose of sobriety. These days the Times is embarrassing to an extreme in the way its headlines so transparently proclaim how hard they are striving to sell particular propaganda points. . .

"Zelensky Plans A Daring Visit To Washington"? What's with the adjectives? Really, why "Daring"? Why not just "Zelensky To Visit Washington." What's `daring' about leaving a war zone? Or is it just the real oddness of a foreign leader addressing our Congress? As we approach WWII levels of spending?

Or could the Times have made the intended objective of this headline below any less blatant?

These headlines were from the same front page this week, both above the fold.

Here, once again, is my 2019 December letter praying for a sermon on peace, praying, if you will, for peace.

Best and blessings to you all this season.

December 19, 2019

Re: An Open Letter Requesting A Sermon About Peace

Dear Reverend Ana,

Last

spring my wife Carolyn and I invested heavily in our congregation’s

fund raising lottery trying to win the prize of choosing a topic for a

sermon you would give. We didn’t win. Had we won, we would have

challenged you with what you might not have found an easy subject,

speaking about Julian Assange, American war crimes, and the U.S. pursuit

of empire. Our choice of subject would not have been be to vex you

with its difficulty, but to ask you to speak to what could be such a

simple concept: Peace. If, these days, conversations about peace are

avoided as difficult, what better than address that difficulty in a

sermon?

Giving it some consideration, I think that

making a worthy case for a sermon topic is a good a way to gain the

prize of having you speak on a topic we care about, as good a way as

investing in fund raising lottery tickets. Therefore I will try.

Is

peace a spiritual thing? Is talk about our common humanity, our common

bonds, and about surmounting the blindness that fractures our

relationships a proper thing to address in religious terms? I

acknowledge I’m being obvious here. What I just referred to is supposed

to be basic and elemental to the great faiths.

I grew

up in the Vietnam War era and I remember churches and church people

taking the lead in saying that the wars we waged in Indochina were

wrong. These days we, as country, are more military extended than

ever. My oldest daughter is now about to be twenty-nine years old. We

had already started bombing Iraq when she was born in January. The war

in Iraq is just one of the perpetual wars that has continued essentially

for the entirety of her life. All of our wars are long now. As

formally measured by some, the War in Afghanistan, with its later

beginning, has surpassed the Vietnam War as our country’s longest war.

These days the United States has been bombing

nine countries, ten if you include, as we should, all of the U.S.

participation in the bombing of Yemen, the other nine countries being:

Mali, Niger, Somalia, Libya, and then, in the Middle East, it’s

Pakistan, Afghanistan, Iraq, Syria. We have 800 military bases in other

countries. With practically no comment or attention from us, President

Obama opened new military bases across Africa.

A peace

symbol hangs prominently in our Unitarian Universalist congregation’s

sanctuary where our sermons are given. We begin every Sunday service

singing the words: “let peace, good will on earth be sung through every land, by every tongue.”

Christmas comes every year, and every year we evoke and extol, as is

customary in the Christian tradition, the image of Jesus as the “Prince of Peace.”

In our congregation’s Weaving Social Justice Committee we have

discussed the prospect of rededicating the side chapel within the

sanctuary that is known as the “Peace Chapel” to that cause. In our list of candidate films for the social justice film series we are working on we have films about the injustice of war. . .

.

. . But, by and large, we hardly ever actually say anything about peace

or the need to end the perpetual wars for which our country is now

responsible. Has there been any sermon in our sanctuary on the subject

of peace? I can’t recall one.

I was not at the

Unitarian Universalist General Assembly in June this summer, but I

talked with people who went, and I looked over the multi-day program. I

was told and I saw that there were no sessions on the subject of

peace. Nor was anything said about the antithesis thereof, war,

although we are deeply embroiled in wars to the point that they are

inescapably always in the background our daily American lives.

Our

congregation through its leaders including members of the social

justice committee is now reaching out to other congregations in our city

and to their social justice actors to coordinate collective activism on

the issues important to all of us. The importance of peace activism

has not been mentioned in those discussions no matter that it is

integrally related to virtually every other issue that is being

discussed of common interest. Has the subject of peace somehow been

tagged as off-limits? Is peace now too controversial to be discussed by

and among religious communities?

Other social issues

have attracted the attention of organizing Unitarians and have been the

subject of multiple sermons. I understand and support that and among

them are issues like the climate change chaos catastrophe emergency.

The climate emergency is an existential threat to all of humanity. When

the Democratic National Committee ordered that there be no debate

focused on the single issue of climate change– the DNC actually forbade

Democrats from participating in any such debate organized by anyone

else– the case was made that the existential issue of climate is so

fundamental that it is intertwines with and underlies virtually every

other issue that’s important. There are other issues like that; issues

that are inextricably related to society’s other major issues.

Our

American wars together with the rest of our military interventions that

stoke conflict in other countries are far too often wars which are very

much about the extraction of oil and fossil fuels. Moreover, overall

our wars help keep in place the systems that continue to vandalize our

planet, exterminating its ecosystems. Further, the US military is one

of the largest polluters in history, “the single-largest producer of greenhouse gases (GHG) in the world,” and that the Pentagon is responsible for between “77% and 80% of all US government energy consumption”

since 2001. The US military is consuming more liquid fuels and

emitting more climate-changing gases than most medium-sized countries,

polluting more than 140 countries. Obscuring the reporting on this, the

United States, which exempts its military from environmental laws,

insisted on exemptions from reporting of the military emissions of all countries from climate agreements. The U.S., has itself escaped such reporting by exiting the Paris Climate Accord.

It

is not clear, but these staggering figures about fossil fuel use

probably don’t include the fossil fuel consumption related to the

initial manufacture of weapons. Consider also that replacement, or

nonreplacement, of what is bombed, burned and incinerated also must

entail substantial additional environmental costs.

It is not just greenhouse gas emission pollution that the military produces: In 2010, a major story that went largely unreported

was that the U.S. Department of Defense, as the largest polluter in the

world, was producing more hazardous waste than the five largest US

chemical companies combined, and that just some of the pollutants with

which it was contaminating the environment were depleted uranium,

petroleum, oil, pesticides, defoliant agents such as Agent Orange, and

lead, along with vast amounts of radiation. Following our bombings,

birth defects reported in Iraq are soaring. A World Health Organization

survey tells us

that in Fallujah half of all babies were born with a birth defect

between 2007 and 2010 with 45 per cent of all pregnancies ending in

miscarriage in the two years after 2004.

Another thing we face that has been deadening to the human spirit has been the increasing “othering”

of people who we are made to think are different from us. Frequently

now that’s immigrants from other countries who are black or brown.

Often that “othering,” as with Muslims, is stoked in ways that

may cause us to support or tolerate wars in which those others suffer

most and towards whom hostilities are often officially directed. We may

also forget how our wars and military activity push the flow of

populations forcing people to migrate across boarders, as, for instance,

with those leaving Honduras after our country helped bring about the

military coup that replaced the government there.

Also

basic and underlying so many of our problems are racial, income and

wealth inequality with concomitant inequality in power and influence.

These are things that Reverend Martin Luther King, Jr., who practiced

ministry through activism and activism through ministry, labored to

eliminate. Not long before he was assassinated, King also began to

speak out against the Vietnam war saying the great challenge facing

mankind is to get rid of war. Before he did so, he carefully weighed

cautions urged on him that as a civil rights leader he shouldn’t do so,

that it would undermine support for his civil rights work, split his

coalition, and that these issues should not be joined together. But

King concluded that the issues were tied together and decided that he would address them on that basis.

When King expressed his opposition to the war in his very famous “Beyond Vietnam -- A Time to Break Silence,”

delivered in this city’s Riverside Church, New York City, April 4,

1967, one year to the day before his assassination, he said he was “increasingly compelled to see the war as an enemy of the poor and to attack it as such.”

He spoke of the disproportionate toll that waging war exacted on the

poor and spoke of the poisoning of America’s soul. . . So it is today.

War is profitable business. It busies packs of lobbyists who know a great deal more about often secret budgets

than we, as the public, will ever learn. But that profit drains the

resources of our society enfeebling our ability to accomplish so much

else. The Pentagon and military budget is about 57% of the nation’s discretionary budget. If all of the unknowable

black box spending that goes into the Military-Industrial-Surveillance

Complex were included, that percentage could well bump up higher. We

spend more on military spending than the next ten countries combined (or

seven, depending on the year and who calculates), and we spend much

more than all the rest of the countries in the world left over after

that. Of course, much of that spending by other countries is on arms we

supply making the world dangerous.

We may not fully

know about or have a complete accounting of all the dollars we spend in

these areas, but, in May of 2011 after the U.S. announced that it had

killed Osama Bin Laden, the National Priorities Project calculated that,

as of that time, “in all, the U.S. government has spent more than $7.6 trillion on defense and homeland security since the 9/11 attacks.” Point of reference: a “trillion” is one million millions.

Just the increase in the military spending in the last two years since Trump came in is as much as Russia spends on its entire military budget ($66 billion). Similarly just that increase is greater than the entire military budgets of Britain ($55 billion) or France ($51 billion).

Our

fixated disposition to keep spending more is entrenched: Even Elizabeth

Warren, a senator from Massachusetts who promotes herself as a left

wing progressive, voted in 2017

to increase the defense budget by $80 billion, surpassing the $54

billion increase requested by President Trump. 60% Of House Democrats voted for a defense budget far bigger than Trump requested.

Perhaps

most disquieting and insidiously corrupting to our morality and our

souls are the pretexts we adopt to justify going to war and to abide its

horrors, particularly when we leave those pretexts dishonestly

unexamined. The public flailed and many among us continue in their

confusion, unable to sort out that Iraq did not attack the United States

or have weapons of mass destruction before the second war that we

unilaterally and "preemptively" launched to invade that country. Before our first Gulf War attack on that country there were no slaughtered `incubator babies’:

That was just a brazen, cynically staged public relations scam.

Similarly, how few of us know and recognize that Afghanistan did not

attack the United States on 9/11– We precipitously invaded that country

because the government there was at that time asking that procedures be

followed and proof furnished before it would assist in finding and

turning Osama Bin Laden over to the United States.

The

foreign country that was most involved in 9/11, and from where almost

all of the men identified as the alleged 9/11 hijackers came, is Saudi

Arabia. Saudi Arabia is the country to which we are selling massive

amounts of weapons (making it that world’s third biggest military

spender) and it is the country with which we are deeply involved

perpetrating war crimes against Yemen.

In the Vietnam

War, our second longest war, it was the Gulf of Tonkin incident that,

not being what it seemed nor reported to be, was the pretext for war.

Perhaps

hardest and most challenging to our susceptibilities as caring people

striving to be spiritual and attentive to justice are the pretextual

manipulations to which we are subject in regard to what Noam Chomsky and

Edward Herman spotlighted as the selective distinguishing between “worthy” versus “unworthy” victims. “Worthy”

victims are those who, whatever their number, deserve our outrage and

are a basis for calls for the international community to mobilize toward

war. “Unworthy victims” are those who can die en mass without

attention or recognition like the tens of thousands of Yemeni children

who have died for lack of food, water and medicine because of Saudi

Arabia’s blockade assisted by the U.S.. Often, as with Palestinians

removed from their homelands, these victims are blamed for their own

victimhood.

Additional layers of pretext pile up when

we encounter journalists and whistleblowers willing to be the messengers

of war crimes. We punish those messengers while, concurrently, there

is no consequence for those who perpetrate the war crimes. Often the

perpetrators are promoted to higher office. That includes those who

illegally torture others to coerce useless, undependable, and likely false “confessions.” Thus we punish and torture Julian Assange and Chelsea Manning for exemplifying what Daniel Ellsberg called “civil courage.” Thus we vindictively send CIA whistleblower John Kiriakou to prison for disclosing his agency’s torture program.

Wikileaks,

Julian Assange’s organization has published much that is embarrassing

to the United States and those in power, much of it is particularly

embarrassing to the U.S. military. Wikileaks has never published

anything that was untrue, but the truth of what it has published is

disruptive to the official narratives of the war establishment. That

establishment has been seeking vengeance against and to neutralize

Assange since events in 2010 when in April Wikileaks published

documenting gunsight video footage, under the title of “Collateral Murder,”

of a US drone strike on civilians in Bagdad provided by Chelsea

Manning. The New York Times and Washington Post did not respond to

Manning’s attempts to publish that same footage through them or other

evidence of U.S. war crime in Iraq and Afghanistan.

Anyone

who wants proof of the pretextual nature of the United States’

persecution of Julian Assange and of the ghastly and sometimes illegal,

abuse of inordinate power against Assange should watch or listen to Chris Hedges June 8, 1019 “On Contact” interview with UN Special Rapporteur on Torture Nils Melzer (“On Contact: Julian Assange w/UN Special Rapporteur on Torture”-

Chris Hedges is an ordained minister in the Presbyterian Church). The

attacks against Assange began with a highly orchestrated campaign of

character assassination. They have progressed to things far worse.

Both Assange and Manning (who was pardoned from a 35-year sentence after

seven years of confinement that included the torture of Manning) are

now being held in prison, no end in sight, for no crimes of which they

have been convicted. I think we have to agree with the criticism of

this as psychological torture. The continued torture of Manning is an

effort to get at Assange even if that were to involve forcing Manning to

lie.

The United States wants Assange extradited to the

Unites States to be tried for the crime of practicing journalism that

was unflattering to the United States government. Somehow we have the

highhandedness to conceptualize this journalism to be treason although

Assange is a foreign national. Assange faces no other charges. Under the

laws pursuant to which the U.S. would try him, Assange, like the exiled

Edward Snowden, would not be permitted to introduce any evidence or

argument that disclosing illegal U.S. activity or war crimes benefits

the public. It’s said that the United States wants nothing more than a

show trial and I think that must be considered obvious.

When

Assange sensed in 2012 that trumped up charges in Sweden would be used

as a subterfuge to transfer him to United States custody for such a show

trial he obtained political asylum in the Ecuadorian Embassy in London.

For this, a British judge sentenced Assange and had him serve 50 weeks

in a high security prison for “bail jumping”; that’s just

fourteen days short of the maximum possible sentence, although the

obviously trumped up charges for which Assange had posted bail were

withdrawn, negating the original bail terms as a result. A normal, typical sentence for bail jumping would have entailed only a fine, in a grave case, a much shorter prison sentence.

Britain was able to send police officers into enter the Ecuadoran Embassy to arrest Assange for “bail jumping”

and then later hold him, without other charge for pending extradition

to the United States, because of a change in the Ecuadoran government

that was evidently CIA assisted,

and as the United States was dangling financial aid for that country.

Assange’s eviction from the embassy, along with his being simultaneously

stripped of Ecuadoran citizenship, was done without due process.

The

persecution of Assange casts a long shadow to intimidate other

journalists, whistleblowers and activists as they themselves are being

intimidated about disrupting the preferred narrative concerning

America’s militarily asserted empire. Other providers of news simply

lay low not reporting things. As neither the New York Times nor the

Washington Post reported it, you may not have heard about the recent scary SWAT style arrest

of journalist Max Blumenthal by Washington D. C. police hours after he

reported about the United States government funding of the Venezuela

Juan Guaidó coup team. Blumenthal was shackled and held incommunicado

for an extended period. Not long after that the D.C. police went out to similarly arrest activist and journalist Medea Benjamin when she publicized the U.S. backing of coups in Venezuela and Bolivia.

With

silenced journalists, will we, based on unchallenged pretexts, send our

military into to change the government of Venezuela as there is talk of

doing? In Bolivia the coup we sponsored has been successful without

that. Meanwhile, there is talk of pretexts for military actions against

Iran, Russia, North Korea.

Journalists who still show courage, are subject to

exile, sometimes self exile, from their journalistic homes, to

alternative media outlets, where, like Assange, they are likely to be

less heard and will be more vulnerable. Journalist Tareq Haddad just announced

that he resigned from Newsweek because that publication has been

suppressing a story of his. His story was about the whistleblower

revelations of buried evidence that the supposed 2018 Duoma chemical

attacks by Syrian president Assad on his own people was fairly obviously

a concocted fabrication when it was used as a justification for the

U.S. to bomb Syria. Remember our bombings of Syria? The was another in

2017. It was for such bombings of Syria the press declared that Trump was finally `presidential,' and, as the cruise Tomahawk missiles launched, MSNBC’s Brian Williams spoke of being “guided by the beauty of our weapons” using the word “beautiful” three times in 30 seconds.

The

strenuous suppression of these voices like Assange's that would disrupt

official narratives shows how the conduct of war has a tight moral link

to the choices we make to speak out against war and against the

suppression of the voices that oppose war. In his sermon against war at

Riverside Church that day one year to the day before he was killed,

Reverend Martin Luther Kings Jr. said that, “men do not easily assume the task of opposing their government's policy, especially in time of war.”

King also said that, when assuming the task of such opposition, it was difficult to break free of the “conformist thought” of the surrounding world. Indeed, with the complicity of a much more conglomerately owned

corporate media than in King’s time, it seems as if there is a

secularly consecrated catechism of what we know we as Americans are not

supposed to say, what we must veer away from and avoid. We subscribe

with almost religious ferocity to the belief that American

exceptionalism justifies all our actions in the world. It feels, as if

in our bones, that we know that to violate this proposition and say

something else would create a rumbling disturbance in the force (you

know, “Star Wars”). Or is our silence, merely something less

profound than that, just the equivalent of what we think would be an

exceptionally super-rude topic to bring up at a family Thanksgiving or

holiday diner?

Dr. King

correctly foresaw that there would be significant prices he would have

to pay for speaking out against our country’s war. He concluded that he

had to do so, that he had to `break the silence,’ despite the

prices he knew he would have to pay. He felt that doing so was the only

thing he could do and remain true to himself and his causes.

Ana,

I have no doubt that there would be prices you would have to pay if you

spoke out for peace; if you spoke out against war. I also acknowledge

that there are prices our congregation could face. Relatively recently

the FBI has raided the homes of public nonviolent peace activists who have long, distinguished careers in public service. (And the FBI has also been investigating nonviolent climate activists and Black Lives Matters activists.)

But I urge you to deliver a sermon about peace because it would be the

right thing to do. Perhaps it could go along with a rededication of our

sanctuary’s Peace Chapel. And, perhaps, if you would give a sermon

like Dr. King gave against our wars, it might do more than just be a

good thing in its own right: It might serve as a model for the ministers

of other congregations who would follow suit.

Maybe,

as in Martin Luther King Jr.’s day, there can again be a time when

people see the call for peace as a spiritual issue and our church’s,

temples and congregations again take a lead role in calling for peace

and an end to our wars.

Have I made the subject of

peace sound as if it is complicated? If so, I am sorry. That can be a

problem in itself. At bottom, shouldn’t this all be so simple? Peace,

supporting peace, speaking out for peace. . Something very simple.

Last night I had the strangest dream

I never dreamed before.

I dreamed the world had all agreed

To put an end to war.*

* From “Last Night I Had the Strangest Dream,” by Ed McCurdy- 1950,

a precursor of sorts to “Imagine” by John Lennon and Yoko Ono- 1971

Sincerely,

Michael D. D. White

* * *

Here are links to the prior Noticing New York ventures into seasonal

reflection:

• Thursday, December 24, 2009, A Christmas Eve Story of Alternative Realities: The Fight Not To Go To Pottersville (Or Ratnerville),

• Friday, December 24, 2010, Revisiting a Classic Seasonal Tale: Ratnerville,

• Saturday, December 24, 2011, Traditional

Christmas Eve Revisit of a Classic Seasonal Tale: Ratnerville, the Real

Life Incarnation of the Abhorred Pottersville,

• Monday, December 24, 2012, While I Tell of Yuletide Treasure,

• Tuesday, December 24, 2013, A Seasonal Reflection: Assessing Aspirations Toward Alternate Realities- 'Tis A Tale of Two Alternate Cities?.,

Wednesday, December 24, 2014, Seasonal Reflections: No Matter How Fortunate or Not, We Are All Equal, Sharing a Common Journey

• Thursday, December 24, 2015, Seasonal

Reflection: Mayor de Blasio, His Heart Squeezed Grinch-Small, Starts

Gifting Stolen Libraries To Developers For The Holidays

• Saturday, December 24, 2016, Noticing New York's Annual Seasonal Reflection

• Sunday, December 24, 2017, This

Year’s Seasonal Reflection: Yes We Are Now Living In Ratnerville,

Locally and Nationally, And Yet We Hope And Work Towards Something

Different

• Monday, December 24, 2018, This Year’s Annual Seasonal Reflection: It Rhymes (But Not With "Reason" or "Season")

• Tuesday, December 24, 2019 An

Open Letter To Reverend Ana Levy-Lyons of The First Unitarian

Universalist Congregation of Brooklyn Requesting A Sermon About Peace

• Thursday, December 24, 2020 Noticing New York 2020 Seasonal Reflection

• Friday, December 24, 2021 Noticing New York 2021 Seasonal Reflection